Introduction

Aims

·

Consider the technology and philosophy behind

block-chain and more specifically bitcoin and its relatives.

·

Look at the astrological charts for some key

dates in the history of the technology

·

Use this information to make some forecasts of

where the currency values are heading.

Technology

I don’t propose to give a full account of the technology

here, I am not a block-chain expert and there are many who would do it much

better. There are links at the end of this post and Google is your friend.

However there are a few key points to note.

Block-chain and bitcoin may be new but many of the

technologies it uses existed before 2008; namely the encryption methods that

allow anonymity, the internet itself which facilitates the distributed

recording and validation, and even the creation of referenced blocks. However

it is the combination that gives the technology its potential.

Note, I refer to the technology here and not Bitcoin or even

“cryptocurrencies” in general. Because there are potentially many other uses of

block-chain that do not involve the creation of a currency. And indeed investment in these may well be

worthwhile, though rather like the original internet I suspect that most of the

best inventions will be created, or at least acquired by large corporations –

pick those corporations and you can perhaps make a decent return.

But at the moment it is the currencies that are being hyped,

(of course they are, as we will see Neptune in the foundation charts is at 22

degrees!) and so it is the currencies that we will primarily concern ourselves

for much of this article.

Part I

Currencies: a little

trip through history

To understand the hype, or perhaps to negate it, we need to

take a step back and look a currencies in general.

We all know the definitions currency is: i) a unit of

account, ii) a medium of exchange and

iii)a store of value. And of course we all know that (unless they have

intrinsic and widespread appeal in themselves), they are no good as ii) and

iii) if there is no trust between the parties: Mr Mugabe take a bow. (Even a currency’s use as a unit of account

is put into question if it is worth 1millionth of its original value, unless

you have a ledger capable of recording Pi exactly!) But it is no joke, we should do well to

remember what the Germany hyperinflation of the 1920s produced in its wake and

we’ll return to the subject of inflation later.

So, that’s the theory but it is what those attributes mean

in practice that is the key to understanding any new entrant. Let’s go back to

absolute basics. What follows is a potted history of money, for extensive

versions see the recommended reading :

Coins.

Of course, now, hard currency forms a minute fraction of all

the money in circulation but that was not always the case. Once upon a time

there were just coins.

Why do we need money? To simplify trading in increasingly

complex societies where for reasons of demand, time and location barter won’t

work. I.e when I supply some financial

astrology services I will get paid in gold which I will use later to purchase

food for my cats! It is most unlikely that you will give me cat treats in

exchange for my services.

So, initially, there were 2 main requirements for a

currency;

Intrinsic value: Gold, and other precious metals, had value

for their ornamental qualities. And, of course. because they were available in

limited quantities, their desirability was preserved. They were thus obvious

choices. And in general we can assume that values of the “currency” at this

point were relatively stable against other assets and commodities. If you

received a coin you knew what it was worth in terms of bread, clothing and

shelter etc.

and

Portability: because

all exchange was physical they needed to be portable. Again the value of metal

per ounce/kg was high so only a small amount needed to be carried.

[It didn’t have to be gold, it could be spices, or silks or

anything of similar value and portability, gold became preferred because it it

did not deteriorate when held for longer periods]

There is also one other characteristic that, almost by

definition, is rarely of interest to the user but has potential importance,

namely that traditionally currency is fungible- one unit looks and behaves just

like another. This does have all sorts of legal ramifications where criminal

activity takes place and innocent parties receive money from that party later

on but for most purposes is something that is just taken for granted.

But what we are missing from this is where the money came

from. Obviously in a simple system A mines the gold and uses it to pay for

food, thus releasing it into the system. Over time the amount in the system rises

but slowly over long periods. If the

value of the commodity/currency rises a lot more people mine until the value drops

again. Just like any other commercial activity whether it is worth mining

depends on the cost of doing so versus the exchange value.

But the value is at

all times determined by the outside market based it desirability for other uses

not as a currency.

It is also worth noting that although rulers did “mint”

currency, they weren’t creating it they were merely branding it. No central

organisation was technically required at this stage, just general acceptance as

to the value of the metal etc.

Of course there were other reasons for the central control

of money ( taxes, etc.) but they were separate functions. The two are linked but not inextricably so.

We’ll return to governments and their desires and powers later on.

We need to understand the downsides of our coins too. Even in

the early days of currency theft was clearly one. Safe storage and carriage

became important. Fakes also appeared and validation (examination, weighing

etc.) was added to the mix.

Notes and other forms

of fiat

Later (to cut a very, very, long story short) two options

developed, i) coins that were not underpinned by intrinsic value and then ii)

paper currency which very obviously had none

It is crucial, here, to bear in mind that the fact that the

currency was no longer backed by anything with intrinsic worth is NOT a problem

per se. Currency becomes a sort of

IOU/Bill of exchange. There is absolutely nothing wrong with that as long as

others will honour it. It is a system based on faith or trust where rather than

trusting an individual to honour your debt you trust the system co-ordinator. If

such a system is supported by a stable State the currency still retains all its

original properties.

Note that, once again, a State is not absolutely required for

this form of IOU to work, it just provides the fiat (the decree or other

determination that a currency exists) which further support and credibility. In

practice this is done by designating the state currency as “legal tender”. But I can still receive IOUs on my own

currency post –it-notes from my friends if we are both happy with that – it

merely means I don’t have to receive dodgy IOUs on post it notes from clients I will never see again; I can now

receive “bills” that are exchangeable anywhere in the State.

On the downside, we still don’t get away from the problem of

theft or that of fakes. New methods must be adopted to minimise these –

normally also co-ordinated by that said State.

But as our currency has no intrinsic value, it can also be

replicated infinitely; we are now exposed to monetary inflation created by

increases in supply, even if that supply is genuine (non-fake) and mandated by

the central co-ordinator.

However, contrary to what you might think, once again, that

is not of itself a problem .If everyone holds exactly the same amount of real

wealth and of the currency, currency inflation will have no effect on the system

whatsoever. The problem is that devaluing the currency makes real assets or

commodities more expensive in relation to income based in the currency. The

problem is NOT the inflation of the fiat currency itself, it is the

magnification of the inequalities that result.

Finally, for completeness, although paper money often has

serial numbers, for all intents and purposes it is still as fungible as the

coins were. The serial numbers are merely part of the creation validation

mechanism, no-one maintains of record of who owns which ones at any point in

time.

Bank accounts

I want to quickly say something about banks. They have two functions that are relevant here:

security of your currency asset and lending brokerage. These are two completely

different functions, just bundled together for convenience. And I’m not going

to harp on about fractional reserve banking in the way that many others do. It

is a red herring and all the qualities of currency that concern us can be dealt

with without reference to it.

I just want to address the fact that stage three in currency

development is for it to lose it physical form altogether. Now instead of holding a note saying “ pay

the bearer the sum of”, we have an account.

It is still an IOU but now we can store our IOUs “safely” in a ledger and

the manager of that ledger ( the bank) will offer further IOUs and accept IOUs for us (for fees of course!).

Again, we don’t need

a government to organise this- although by convention we tend to hold our

accounts in our State branded units. Our trust in the currency remains with the

State, our trust in the “storage” is in

the banks ( subject to any State guarantees).

And, again, to complete the picture the “IOUs “ in these

accounts are still fungible. I don’t care and you don’t care, nor can either of

us tell, whether the transfer of virtual bills the bank made on my behalf to

pay you for my cat food came from my client

last Thursday or from my Great Aunty Mabel as a Christmas present.

Digitisation

Obviously the advent of computers meant that the ledger IOUs

got digitised. Nothing changed about the nature of the currency itself.

And of course with that digitisation came new theft/security

risks. The methods might change, the fundamentals

of the system did not.

Debt

It must be apparent from the foregoing that all currency (

the “bills” or “IOUs”) held by us

(whether coin, paper or ledger) is just debt owed to us by others. When

we borrow we just get given some tradeable IOUs ( that we can pass on in

payment for a house/car etc) in exchange

for the lender receiving our longer term IOUS and fees ( interest etc).

Now that is another thing that doesn’t matter per se. Indeed

it is inherent in the system and when the system works it is absolutely fine.

The problem, which I have dealt with extensively elsewhere,

is that people and governments take on too much debt.

The power of the state

As mentioned, the state is often the creator, co-ordinator

and brander of a currency. But the state as well as providing a stable medium

of exchange has a lot of other goals and primary among these is stability of

the State itself. I don’t want to get into a discussion of competitive economic

systems here, though they are highly relevant to our debate. Instead we will keep to general terms. Depending

on the model , to maintain stability the state will to a greater or lesser

extent do the following:

·

Collect and

re-distribute taxes

·

Maintain infrastructure

·

Create laws and regulations

·

Maintain a military and /or law enforcement.

If it sees its stability threatened it will legislate and or

act accordingly. And be surrounded by a whole lot of lawyers rubbing their

hands together in glee.

It is worth reviewing the history and hype of the internet

at this point. Remember that free and easy marketplace and free speech platform

that the early adopters preached about. Now remember the Spyware act in the US, Data

protection in Europe, Intellectual property cases, debates about inappropriate

content on social media and whether the social media sites ( or the IP

providers etc) should be monitoring them and especially remember the on-line

gambling bans. And that does not include China, and other regimes where information

is carefully managed, e.g. Turkish social media ban following the alleged

attempted coup.

But it is not just directly applicable regulations that they

can control.

Yes, governments can stop sites, they can block whole chunks

of the infrastructure from working and they can even get into the supply chain

and taking out the innocent middle man to stop the operation taking place as

they did with credit card providers in the gambling example.

They’ll get their hands on the taxes too; somehow… at some

point in the chain, even if they just have to collect sales tax from sellers or

raise import duties.

And as a last resort

they’ll send in the military.

All this we need to bear in mind when considering how likely

we are to have a new significant currency take over.

That’s the basics of traditional currency then, so how do

these so called “crypto currencies” differ?

Part II -“Crypto-currencies

“

Obviously, by definition, crypto currencies are not coins or

notes etc. They are entries on a digital ledger. But they have some special properties that

separate them from the digital currency accounts already discussed .

Let’s take bitcoin as our example here as it is still the

best known. We’ll use Satoshi Nakamoto’s

words from the original paper here:

·

Double-spending

is prevented with a peer-to-peer network.

·

No mint

or other trusted parties.

·

Participants

can be anonymous.

·

New coins

are made from Hashcash style proof-of-work.

·

The

proof-of-work for new coin generation also powers the

·

network

to prevent double-spending.

We’ll now look at these characteristics within the context

of the properties of money to establish to what extent they differ from

traditional currencies and to what extent those differences make them more or

less attractive.

Medium of exchange

Trust

No mint or other trusted parties

Note that Satoshi doesn’t call Bitcoin a crypto-currency, he

calls it a peer to peer one. The key feature of Bitcoin is its peer to peer

facility. So in theory we get round the problem not just of the dodgy third party but we also

do away with the bank central government money creator/coordinator ( I won’t

use the word mint as this suggests coins rather than IOUs).

As we’ve seen this central co-ordinator is not a

pre-requisite for any system and its purpose has been provision of an

underlying level of trust; the safer the State the safer the currency .

In theory, with this blockchain and the distributed and

secure technology we don’t need a trusted central party. Validation is done by

the system as a whole (for a fee) and security is built in. We can circumvent

the state.

But if you trust your State even marginally why would you

need to circumvent it and replace it with random selection of people across the

globe?

However, there is also the other question of trust; to

what extent does the State inflated away the value of its currency by

increasing its supply – we’ll look at that under “the value of bitcoin” at the end of this section.

Security

issues

As

well as the protections afforded by cryptographic keys,

Double-spending is prevented with a peer-to-peer network and The

proof-of-work for new coin generation also powers the network to prevent

double-spending.

The double spending problem is one that arises due to real

time gaps ( whether days, hours or seconds) between payments and validation of

the transaction/remaining balance.

Despite Satoshi’s words Bitcoin did run into this problem initially

though it is less likely now :

For example: A bug that led to creation of more than

184 billion bitcoins ( many more than actually possible) caused hard fork (9

Feb 2011)

However as we know, it is possible for any system to be

breached. Coins could still be double spent in fractions of a second,

especially as volumes increase. I am prepared to be persuaded this can be

prevented but I am not yet convinced.

Exchanges

and wallets

Although

there is no “mint” for creation, the trusted party problem may remain for

storage. Exchanges weren’t in Satoshi’s summary as clearly they negate the peer

to peer nature of the currency.

But other exchanges have had problems too: the alleged Ponzi

, Bitcoins savings and Trust (17 Aug 2012), and the hacked Linode (1 March

2012).

Obviously using an exchange for storage is just as

risky as using a bank or other intermediary ( well more so since there are no long

established brands to protect and no government guarantees)

So a wise true

peer-to-peer holder needs to keep their coins in a hardware wallet or write

down the details. Even then there is a

risk of loss of wallets (destruction of your computer/loss of access details). And

I’m not sure what happens to your bitcoin wealth if you die without passing on

the details of your wallet/coins.

Buying bitcoin

In Satoshi’s model,

you would receive bitcoin in payment for something. In practice people are

buying it. But to buy it you need to spend a traditional currency. You are NOT,

until you are actually in possession of your validated Bitcoins, benefiting

from the technology that manages them so you run all the risks that buying any

other commodity with traditional payment incurs.

Acquiring coins at

source

New coins are made from Hashcash

style proof-of-work. (

i.e They can be “mined”.

In this way they are more like precious metals in that they can be obtained

at source by workers.

Of

course just like any mining you have to be in it to win it. And just like any

other form of manufacturing it is cheaper some places than others. Ironically

it is differences between states that create environments more or less

favourable for mining. China policy on electricity as made it a preferred

location. Mining has got more attractive as the price has risen but the in-

built halfing mechanism that slows the increase in supply has the opposite

effect.

Satoshi

did not deal with inherent inequalities in the system ; whether regional,

economic (ability to buy the equipment)

or knowledge based – ability to “mine”. Tacitly his concept was the

implication that everyone could mine in the same way if they chose.

There

are therefore potentially some inherent problems in the issuance that reduces

the likelihood that the currency will ever be widely held. But that also

depends on other factors that we will address at further on.

Anonymity and

fungibility

Participants can be anonymous

Due to the public/private encryption only the coin and its

payment history is identifiable and not the owner.

This has two implications

i)

the currency you hold is no longer fungible (in

my view, though some definitions of fungibility depend on substitution of

similar items)

Of course, as we already established the average person

doesn’t care which coins are used for what. So this is no advantage for a

currency, and can even be a disadvantage, if funds received in good faith turn

out to have a dodgy source. I am not a lawyer but I’m sure that some of them,

at least, will get rich on debating this!

ii)

you can operate peer to peer anonymously without

a third party ( contrast this with for example paypal where a third party keeps

both parties details).

The question is why would this be of especial interest to the average

person. I’ve not entered into a financial transaction with any person or

organisation yet that I need to withhold my details from.

So it is an advantage in theory but not one the majority

care about. Of course it has become well known that black market trades have

tended to migrate to Bitcoin. The Silk Road being the best known one ( Founded

Feb 2011, alleged founder arrested 1 Oct 2013 3.15pm PDT )

Competing currencies

One of the key factors, other than trust, that makes a

currency work as a medium of exchange is its ubiquity . Within a country or

region everyone accepts and gives the same currency and approximately knows

what they can get for it, not because it is the legal tender but because it is

the most accepted means of payment. I

really don’t want to have to pay for my milk in wibbets and my bread in

wobbets.

Of course if you have competing currencies it isn’t a

problem if:

·

exchange is easy and cheap.

·

The exchange rate is relative constant so

you waste little time in comparisons

But if either of these criteria fail, then the less

attractive currency will fail.

We can say with the certainty that one attaches to the

winner of network effects that one will dominate in the end.

At the moment there are many such currencies, whereas “

there can be only one” or at least one global

one and one per region/country.

Much of the foregoing discusses the theoretical properties

of bitcoin. For the man in the street, however, the daily concerns are more

practical. There was an interesting report in the Evening Standard of a literal

Payments Race that took place in June 2017 from London to Copenhagen.

Participants tried to make the trip using only one type of payment; e.g.

contactless, chip and pin, gold, coins and of course bitcoins. Sadly the result

would not make Satoshi a happy bunny: Not only was the winner the gold carrier but

the worst result was the bitcoin racer who failed to make the journey at all.

The result can be found here and makes an interesting listen

for any geeks wanting to understand the gap between the utopian technological theory

and the practicalities of dealing with uninformed populace on one hand and very

slowly evolving organisations on the other.

I particularly liked the bit about the teenagers being the only people

offering to accept bitcoin but not actually able to deliver the transportation.

https://www.youtube.com/watch?v=OGFWLD15iVk

I’d also like to add that about 10 years ago I was an attendee on a consumer panel at the UK payments council

looking at the abolition of cheques with

a 2018 target. After a few years the plan was shelved. There are

people at the other end of the spectrum from the geeks who are not going to

give up the old ways and in some cases are physically unable to do so. Rome

wasn’t built in a day and nor was the Euro. We will get there one day but I

don’t see it happening in the next few years.

Units of account

As units of account, individually, Bitcoins obviously function

just fine, but then so does every other currency when recorded digitally. The

only difference with Bitcoin is the fungibility which we’ve already touched on.

But we also need to account for masses of bitcoin. For

global acceptance we need to be able to record national GDP at one level, and

yet our developing country worker needs to be able to receive his bitcoin

equivalent of a $1 a day. Bitcoins were created with a practical upper limit

expected to be around 21 million. That’s not many right?

But, no worries, it is possible to have bits of bitcoin, 100

million bits in fact, so in total we can have 2,100 trillion units. To give

some perspective total global debt is around $200 trillion or allowing the full

spectrum of units for those who only earn cents per day 20,000 trillion units. And,

in any case, much of the consolidated figures we deal with aren’t currency transactions but the sum of those transactions

for reporting purposes. The upper limit

of bitcoin is only for the number in issue, it is not for total wealth and we

can easily record on paper an infinite sum ( indeed I’ve already used a number

bigger than 21m in this article).

So we can theoretically account for enough bitcoin in the

foreseeable future. So, great, for units of account purposes we can distribute

our bits of bitcoin globally and there’ll be enough to go round when we want to

account for global GDP numbers and for the kiddies sweets.

The practical problem of scalability is not whether we can

have enough bitcoin, it is recording and validating them as they start to

become more accepted.

Remember bitcoin aren’t fungible, each one is identifiable,

but to make that worthwhile each one must be validated each time it is

transferred. That’s like giving each cent in your account a unique identifier

and noting how you spend it. But since bitcoin requires mulitple system

participates to validate a payment, that means that you could flood the system

just by making a load of £0.01 equivalent payments. Worth it just for the

laugh, eh?

Or as one commentated put it “To grow to a planet scale,

Bitcoin will a) require a radical re-architecture or the successful

implementation of an off-blockchain payment system, where the blockchain merely

functions as a dispute mitigator. To put the problem in perspective: if 7

billion people perform 2 transactions a day, that alone gives us 24 GB blocks,

generating a blockchain of 3.5 TB a day, or 1.27 PB per year.”

https://github.com/the-laughing-monkey/cicada-platform

i.e there just aren’t enough resources in the network to

maintain the level of validations required. So

something will have to give. And if something gives the initial vision

is lost.

Trust in a store of

value

Given that the core element that makes something a currency

is "anything that is accepted as a medium of exchange", there are no

barriers to Bitcoin and the like being a currency but the key question is how

does it get past the general acceptance point?

The real debate that generated the initial interest in these

currencies was not about their capability to form a trusted medium of exchange,

or about their operation as units of account but about their ability to be a

store of value; an answer to the problem of traditional currencies such as the

dollar or sterling being inflated away by the increase in the money supply.

Indeed Satoshi’s original post on 3 January 2009 was accompanied by a reference

to the UK chancellor’s increase of the money supply.

Although we aren’t there yet. At the moment the number of bitcoin is still

growing just like government fiat. But there are also issues of how to scale it

emerging; for example see the split into Bitcoin and Bitcoin cash Aug 1 2017. So

if the logic is extrapolated, it is currently a worse bet than government fiat!

The value of bitcoin

Contrary to what some believe, Bitcoin is NOT analogous to

old fashioned gold.

As we saw, at the beginning, gold was chosen because it had

an intrinsic value as a decorative commodity that had uses. And that its value was dependent no just on

how much of it was available but on its intrinsic use outside the currency

system.

Bitcoin, is a virtual construct. I can use it to make payments but whether there is one bitcoin, 21 milllion bitcoin or infinite bitcoins, I can never plaster it all over my ceiling or on my cakes. Outside the currency framework it is worthless. It’s only authority comes from Satoshi’s paper- it is therefore a fiat currency just like all the rest.

Bitcoin, is a virtual construct. I can use it to make payments but whether there is one bitcoin, 21 milllion bitcoin or infinite bitcoins, I can never plaster it all over my ceiling or on my cakes. Outside the currency framework it is worthless. It’s only authority comes from Satoshi’s paper- it is therefore a fiat currency just like all the rest.

The only difference is that (eventually) it has a finite

level.

Indeed had all bitcoin been mined and released at once or over time at the same price or with

very slight increases in value and we had now reached 21 million spread

widely the lack of intrinsic value might

not have been an issue. The security issues coupled with the fixed supply might

have ensured confidence.

Instead, Bitcoin has not only been mined by a relatively

small number of people but it has increased exponentially in value lately. When

the goal of a currency is stability, a rapidly increasing value one is as

destabilising as a hyperinflating/depreciating one.

To understand the problem let’s look at an extreme example. Jack

and Jill live on an island with 1 million people. The island has a currency

which has depreciated due to increasing supply over many years. Jack and Jill

decide to create a currency called ja-jis. They are able to brand it in a way

that can never be copied and because of that there is an upper limit to the number

of units. They use it in in exchange between themselves for a few years then

open it to others.

And now Jack and Jill still own 90% of it- they have

apparent vast wealth. And the 20000 have varying amounts. But the other 98% can’t

afford to buy ja-jis and since they have no intrinsic value don’t need to. Without

a “system administrator” such as a stable government where is the incentive for

the average person to accept a new currency as payment?

It is conceivable that the price will drop in an orderly

fashion until more people are able and wish to participate but the drop is

likely to put them off. In practice the

bubble will pop as the 20000 lose faith and the currency will end up worthless.

Contrast this will another similar island. There the

government realises that faith in their money supply is faltering. They issue a

new currency similar to that created by Jack and Jill but they do so by setting

a rate on one day that people can exchange their old currency for. With 100%

the currency widely held and used, it is a success and its value remains stable

so there is no speculation in it.

And that brings us back to the question of government power

and how that relates to Bitcoin.

Bitcoin and

government power

So far different governments have reacted in different ways

but there are some common themes.

Japan has declared bitcoin legal tender on 1 April 2017. As

a headline that sounds like a win for bitcoin holders. But the devil is in the

detail, declaring a currency legal tender brings it under all sorts of other

legislation including money laundering, which for a currency which prides

itself on anonymity is a bit sad.

China has been less subtle. On December 5 2013, China banned

financial institutions from using Bitcoin. On 10 april 2014 its state bank

cracked down on bitcoin exchanges. More recently , 4 Sept 2017, it has banned

ICOs.

And in the US, and bitcoin was declared a commodity on 18

Sept 2015 thus trapping it under another set of legislation.

A finally, New York

state, a leader in the gambling regulations already mentioned, released Bitlicenses in June 2015 with

regulations specially targeted at the currency itself.

And you can bet that if they think bitcoin transactions

might exclude the taxman from the picture they will be even more vigilant. On

March 26 2014 the IRS declared that bitcoin was to be taxed as property.

Obviously, since ownership is hidden, this requires declaration but

non-declaration is a crime and I can bet

that they will merely transfer tax collecting to other points in the spending

chain ( e.g sales taxes) if bitcoin

take-up becomes more widespread.

And of course

ultimately they can always play the defence card citing the currency supports

terrorists or rogue states. Then it is toast.

Clearly the vision of peer- to-peer transactions, free of

the influence of third parties, whether state or otherwise was just a trifle

naïve much like the initial view of the internet.

My contention is therefore that for a new currency to be

accepted from the group up would require a complete breakdown in other elements

of the State first.

Readers, who’ve already looked at some of my predictions

will know that there is likely to be significant instability financial and

otherwise in the next three years. Does that mean Bitcoin and co will have

their day in the sun or that something else will happen?

Part II The Astrology

of Bitcoin

Many moons ago, back in 2003 I think, I conducted a detailed

review of major currencies and the dollar in particular, looking at key zodiac

degrees highlighted in currency charts. I concluded at the time that around

18-19 degrees was an important currency degree, 22-23 degrees was also

important particularly for the dollar and that 4 degrees Virgo was a

significant dollar exchange point.

It is interesting to see, then, that the charts for Bitcoin

also highlight some of those degrees, as well as 0 degrees which does not

feature in the dollar chart at all and does speak of new beginnings.

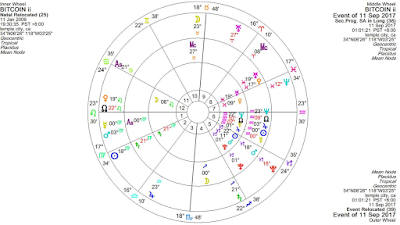

But I am jumping ahead of myself. Let’s look at the charts

Bitcoin Paper: Fri Oct 31 14:10:00 EDT 2008 NY – the

chart is set for New York where the owner of the email server for the crypto

group that Satoshi published through is based.

It is my contention

that this chart gives us an indication of the philosophy behind the technology

and whether it will be well received and adopted. And while it might tell us

something about the currencies I don’t think it is the best chart for that.

One of the reasons

I think that is the position of Pluto at 29 degrees Sagittarius in the chart.

This contrasts with the later charts where Sagittarius has moved into Capricorn

and becomes more concrete. This is further confirmed by Mercury in Libra

– suggesting the idea is somewhat utopian. The Moon also appears in Sagittarius

indicating the plans for changing society.

Neptune is at 21

degrees, and again it is the later charts that we see it at the key 22 degrees

currency point.

The Sun is in

secretive Scorpio, perhaps saying something about the founder.

Then we have the

configuration that describes our technology- Saturn at 18 degrees Virgo opposes

Uranus at 19 Pisces and is supported by Jupiter at 16 Capricorn and Mars at 18

Scorpio.

1st Bitcoin mined: 3 jan 2009 18.15.05 UT ( set for Dublin

though competing locations have been proposed)

This chart ought to

be the perfect chart for nailing Bitcoin’s future. But the uncertainly over the

location weakens it. It can be used to answer value questions but with care.

As mentioned Pluto

is now in early Capricorn- we have our change made real. Mercury this time is

also at an early degree.

And once again we

have a planet at 29 degrees, this time it is Jupiter. This is then showing that

we are once again at a change point. We

have created our Bitcoin but nothing more has happened.

There is some cause

for concern though as now the Moon in Aries is square Mars in Capricorn, some

issues relating to the situation of the Bitcoin miners and the general public

may be surmised.

First bitcoin peer to peer transfer: 12 JAN 2009 3.35UT.

In the absence of certainly regarding Satoshi’s location I have drawn up the

chart for Temple City CA where Hal Finney the recipient was based

This is the best

thing we have as an initial trading chart (though there was actually no trade

involved- the first real trade was a pizza purchase in 2010). I think this chart

can tell us the most about how Bitcoin may function as a currency. The fact

that the node appears exactly on the Ascendant of the original paper’s chart

seems to confirm this.

But this time we

see evidence of a currency actually forming. The Sun is now at 22 Capricorn

which both echoes the Neptune at 22 Aquarius but also supports the Uranus-

Saturn opposition again. We also have an Ascendant and Mid-heaven, albeit of

the recipient and we see that the MC is at 18 Taurus, also a key currency

degree but yet tending to support the

other 22 degree configuration, while the Ascendant is at 23 degrees Leo

opposite Neptune.

Nevertheless we

still have a hard aspect to the Moon. It is opposite Mercury. We are looking

for a medium of exchange so no aspect would be worse, but I can’t help feeling

this might lead to some challenges. Indeed I see this as perhaps being the

problem of sheer volume of transactions to be validated.

But what surprised

me about all three charts is not what was there but what wasn’t.

In the US dollar

chart there is a conjunction between Neptune and Jupiter which widely opposes

the currency’s Saturn. It is this conjunction at 28 Libra that represents the

faith elements of the currency and its tendency to inflate towards the

infinite. While the Jupiter in the bitcoin mining chart is square the dollar’s

Libra conjunction, the bitcoin payment

chart makes no aspect to it.

However the progressed Neptune in the dollar

chart is at 0 degrees Scorpio, so the emphasis , particularly in the bitcoin transfer

chart on 0-2 degrees is suggestive of a link. And this applies particularly too

the Jupiter at 1 Aquarius.

So I am going to

focus on this 12 Jan 2009 chart for the purpose of analysis and forecasting.

The first date I ‘d

like to look at is that of the first dollar/bitcoin exchange on 12 October

2009. At this point Bitcoin was valued at just $0.001. Neptune was by now at 23

Aquarius exactly on the descendant, while Uranus was at 23 Pisces, so a perfect

time for it then. Jupiter opposes the bitcoin progressed moon at 17 Leo and the

progressed MC at 19 Taurus was sextile the chart’s Uranus: time to reach more of the people. All this

was triggered by the inner planets on the day, Mars sextile Venus and Saturn at

28 degrees ( ref. the US chart)

Our next date is

the weird hard fork of 15 August 2010. Saturn opposed Jupiter and squared the

Bitcoin Jupiter; big tech surprises. These were accentuated by Uranus quincunx

the progressed Moon at 29 Leo- something needed to change, and a Mars square

Mars (attack). The Sun was at 22 Leo on

the Ascendant throwing light on it all. Anyway, Bitcoin was still worth less

than a dollar.

Some new exchanges

were created on 27 March 2011. Neptune was at 29 degrees, on the point of

changing things significantly. The Sun was making a favourable trine/sextile

aspect to the Moon/Mercury opposition encouraging the world to use the

currency. Mercury the key to exchanges was at 23 Aries and was trine the

Ascendant. However Saturn was again opposite Jupiter but now it was at 14 degrees

square Mars. The moment was not without challenges.

On 19 June, when

Bitcoin was valued around $18, Mt Gox was hacked. Neptune had reached 0 Pisces

indicating a change of environment. The progressed Moon was trine Mars, Jupiter

was square the chart Jupiter , Pluto was quincunx its Moon and transiting

Mercury triggered it all off with an quincunx to Mercury.

Another exchange

hack, this time Linode, happened on 1 March 2012. But this was less publicised

and there are less specific indicators. However it is apparent the wider conditions

weren’t so good for the currency with the progressed Moon conjunct Saturn and

transiting Saturn at 29 Virgo.

The first halving

day took place on 28 November with Neptune still at 0 degrees. Transiting Pluto

was conjunct transiting Mars that day.

The progressed Moon was activating a square to the chart’s Pluto though

trine its Jupiter, it was transforming in order to grow. Transiting Mercury,

sitting at 18 Scorpio on the chart’s MC, defined the day by changing the

foundations

Our next key date

is 10 April 2013 when volume broke Mt Gox. In six months the Bitcoin had risen

from $12 to $180. On the day, and really all we need to know, was that there

was a conjunction of the Sun, Mars, Venus and the Moon at 23 Aries. Progressed

Moon was trine Progressed Mercury making trade much easier. The progressed MC

had reached 23 Taurus square the Ascendant. And Pluto continued its slow

transit over Mars.

There appears not to be too much new in the

December chart of the Chinese ban, perhaps the chart relocated to Beijing would

show more. Bitcoin was $1000 by now.

But there is more

to say by 24 February 2014 when Mt Gox closed. Now transiting Neptune is

conjunct the transiting Sun and quincunx the chart’s Moon. Saturn has reached

23 Scorpio opposing the progressed MC and square the chart Neptune. A Jupiter Uranus square also aspects the

chart’s Mars. A definite time of challenge.

A month later on 2

March the IRS reached its decision on bitcoin taxation. Transiting Sun opposed

the chart Moon and the cardinal cross was at one of its most intense times.

Clearly this had global significance. And these challenging conditions

continued to weigh on the fledgling’s price all through that year and 2015 when

Pluto continued to conjoin the Bitcoin Mars,

Uranus was around 19 Aries and Saturn moved back and fro across 0

Sagittarius.

By the end of 2015

the focus was still tough but was shifting to media events; notably the 8 Dec

2015 fake Satoshi identification. The progressed Moon trine Venus and Sun

square progressed Venus, progressed Ascendant and Sun at 29 degrees as well as

Jupiter conjunct Saturn in the chart all showed the focus. But Bitcoin was

still stuck at around $400.

More media coverage

(Moon progressed trine Venus progressed) accompanied the next halving day on 9 July

2016. The focus was back on the tech though with Uranus quincunx transiting

Mars and trine Ascendant, Pluto crossing the progressed Mars and naturally a

Jupiter opposition to the chart Uranus. Bitcoin was then valued at$650

But it was the next

few months, devoid of relevant individual events, that indicated the new

trajectory. In August 2016 the Ascendant

progressed into Virgo and applied to a

trine with the chart Pluto; things were getting intense. In October there was a

key turning point for investors as the progressed Moon crossed the IC. Then in November there was a real boost to

the currency as the Sun progressed into Scorpio and accompanied progressed

Mercury in a conjunction with the Bitcoin chart Jupiter. This was bound to blow

things out of proportion. And it did.

For the next six

months with the progressed Sun, Mercury and Jupiter getting closer together the

price rose and rose. On 1 April 2017 when Japan deemed Bitcoin legal tender,

the price was $1000 and even some tricky aspects weren’t enough to cancel the

power of the conjunction.

The price was still

rising rapidly by August, $2700 on 1st, $4700 by 31st.

The progressed Moon had reached 29 Scorpio though and by September was at 0

Sagittarius. Media coverage had heated

up with Jupiter sextile Saturn, Venus was transiting the Moon

The last gasp was

the Saturn station at 21 degrees ended and as the Sun – Mercury conjunction by

progression was exact, the progressed Moon at 0 Sagittarius was square the

progressed Ascendant and sextile that conjunction and Uranus was trine Mars at

the month end.

But what about the future?

Part III – The

future value of bitcoin

Happy in the

knowledge that our chart describes the action to date well, we can now go

forward and look at what might happen next. Of course, as always, caveat

lector: this is experimental forecasting on a newish chart.

Progressed Neptune

will remain at around 23 degrees and on the Descendant of the chart till around

2040-2050. That is the timescale we are probably looking at for change. But

over the next few years progressed Venus will conjoin Uranus suggesting

volatility of both value and media frenzy.

By December this

year (2017), Neptune will be sextile the

chart Mars and progressed Sun will be approaching Jupiter. Transiting Jupiter will be on the MC. These

elements suggest another, albeit smaller rise around. These configurations will

remain through 2018 too.

2018

On the other hand

Pluto will continue to square progressed Mars and transiting Saturn will

conjunct the chart’s Pluto. That is highly depressive. I suspect the Saturn

aspect will win and we won’t see any significant price increase for Christmas.

There is even a risk that it might die in its current form.

By around 7th

Jan 2018, transiting Jupiter and Mars cross the IC. And the Sun and Venus

transit join Pluto in transiting progressed Mars sextile progressed Venus.

Expect huge trading issues, and attacks at the foundations together with more

media activity.

February sees a key

turning point with Jupiter at around 22

degrees square Neptune and progressed Mercury retrograding back to Capricorn

and the established way.

March sees Jupiter

station at 23 Scorpio square the Ascendant.

This suggests challenges caused

by too much growth – and perhaps by the multitude of competitors. However the

progressed Moon is now trine the Moon, a good time for the wide population to

be included

April is challenging as Saturn forms a conjunction with Mars at 8

Capricorn- there maybe legislative difficulties or suspensions of trade.

Around May 5th

Jupiter crosses the IC this time retrograding and throwing up the issues of

March again. Uranus square’s Mercury; a very important time for the currency

and the technology.

June is accompanied

by significant drama. Uranus squares that progressed Sun and Jupiter. Huge swings in value could result.

July and August is

a difficult time when there are technical challenges as transiting Mars retrogrades and stations on

progressed Mercury while Saturn retrogrades to the chart Pluto.

September brings the final transit of Jupiter across the

IC and brings to a close the events of February onwards.

And from the 2nd

November the situation is more challenging as Jupiter opposes the progressed

MC. Nevertheless Mars crossing Neptune may bring a buying spree.

Late November and

December seem to confirm that as Jupiter sextiles the progressed Sun /Jupiter

configuration. Although once more this creates technical issues reflecting the

Uranus square progressed Mercury.

2019

In 2019 The

progressed Sun will be approaching the progressed Jupiter, once more this gives

a positive slant, though perhaps not as much as mid 2017.

January 2019 in

mixed, Uranus is stationed square the chart progressed Mercury which I take to

be revamping of the technology taking more traditional matters into account.

Saturn crosses Mars for the first time and Pluto will now reach the chart’s

Sun. This has some of the feel to

December 2017 rather challenging.

March to May sees this continue and more trading

restrictions. However there is a boost to the technology opportunities from the

media as Uranus sextiles the progressed

Sun and Jupiter again and transiting Jupiter conjuncts the progressed Moon even

though square Uranus and the progressed Venus. And when Jupiter trines the

Ascendant and sextiles Neptune there might be a lot of froth to the price.

By June Neptune has

reached 18 degrees and things should eb looking interesting globally. Jupiter

conjncts the progressed Moon but now is square Saturn as well as progressed

Venus etc , a critical time for technology development. Pluto, however remains

close to the chart Sun and Saturn to the progressed Mars. Don’t expect

everything to be so rosy.

In August things

maybe briefly positive as the progressed Moon sextiles the Descendant.

September and

October see really fundamental changes to the technology as Pluto not only conjuncts progressed Mars

still but now also squares progressed Venus and

Uranus whileJupiter trines the same point. Then Uranus once more squares

the progressed Sun and Jupiter. It looks like all change. And it might even be

positive value wise by the end of the period as transiting Jupiter and Venus

together trine the Ascendant and progressed Moon.

But that is a short

term boost as afterwards progressed Venus separates from Uranus and moves

oppose the chart Saturn.

By December there

are likely to be massive flows of funds everywhere ( not just in relation to

this), Jupiter is conjunct Pluto, Pluto conjoins the chart Sun again, Saturn

the progressed Mars and Uranus squares the progressed Sun Jupiter

configuration- a perfect storm. The pace of change is rapid as progressed Mars

sextiles Venus and Uranus.

2020

2020 begins with

the major Pluto conjunct Saturn – on the chart’s Sun. That is not good. At the same time the progressed MC moves in

to Gemini- we are in a new environment.

April to June

everywhere is a long period of adjustment. Neptune at 19 degrees sits on the

chart Uranus, suggesting confusion regarding the technology- perhaps it is not

clear exactly how thinsg can be harnessed for the best going forward currency

wise. Saturn is conjunct Jupiter- growth

is constrained, and the progressed Moon reaches Pluto- not a great time for an

investor.

July may see the

birth of a new version and certainly huge expectation. Neptune is at progressed

Uranus and Venus and sextile progressed Mars and Pluto together with Jupiter ( rather than Saturn)

is on the chart Sun.

August and

September see this continuing but Saturn remains on the progressed Mercury,

restrictions on trading may remain in place throughout.

October and

November are likely to see the completion of the process as the 2020 Pluto

Jupiter and Saturn conjoin the Bitcoin Sun.

December is then

the start of a whole new ballgame. Progressed Venus opposes Saturn, bringing

the values right down. Pluto remains on the Sun, at best creating something out

of the rubble. But Saturn and Jupiter move into Aquarius and reach the exact

progressed Sun Jupiter conjuntion. Now we will see what the future will look

like.

2021

Briefly we can look

at early 2021 too. The impact on value

will be felt when Saturn reaches the progressed Sun in March. With progressed

Venus opposite Saturn it looks like everything is restrained despite the

Neptune conjunction with Progressed Uranus and Venus. Indeed with Neptune

starting to oppose the chart Saturn everything maybe depressed. Added to this

Pluto reaches the progressed Mercury. The idea is being reformulated completely

by April.

So in summary,

having looked at the realities of the currency and the charts, and although I expect a bit of soul searching

in the coming months I don’t expect Bitcoin to end this year and if it does the

other crypto -currencies won’t. This debate will go on with a mix of

re-workings and upsurges until 2019. By then we’ll see the bigger picture in

terms of real world currencies. I do believe that there could be more upside in

2019-20 but I think in the end the governments will work out a way to restrain

the more utopian elements of the technology and together with some of the banks

start to incorporate some of the more palatable elements into their own state

backed currencies. Bitcoin and its

friends will be over by 2021 in their current form. But so will the credit boom

that characterised 1981-2020.

The long term story

will continue over the coming decades.

Data sources:

First bitcoin transfer https://blockchain.info/fr/tx/f4184fc596403b9d638783cf57adfe4c75c605f6356fbc91338530e9831e9e16

The payments race : http://www.paymenteye.com/announcements/social-influencers-compete-in-the-payments-race-to-money-2020-europe/

Bitcoin key dates

https://99bitcoins.com/price-chart-history/

All about bitcoin

–some starters for 10

https://bitcoin.org/en/how-it-workshttps://medium.com/blockchain-review/how-does-the-blockchain-work-for-dummies-explained-simply-9f94d386e093

Another

perspective on the astrology of Bitcoin

http://www.financialuniverse.co.uk/exploring-bitcoins-astro-code-part-one/

The Ascent of Money: A Financial History of the World

Paperback – 5 Apr 2012 by Niall Ferguson

Comments